Imagine buying a coffee at Starbucks and then suddenly, you’re now an investor in Starbucks.

That’s the idea behind a new app called Grifin, which monitors your transactions and then uses that information to buy stock in the companies you do business with.

“I think that the truth is that investing can be intimidating,” said Aaron Froug, the 26-year old behind the app.

“Grifin stands for greatest revolution in finances now,” explained Froug, an enthusiastic entrepreneur, even through a Skype interview.

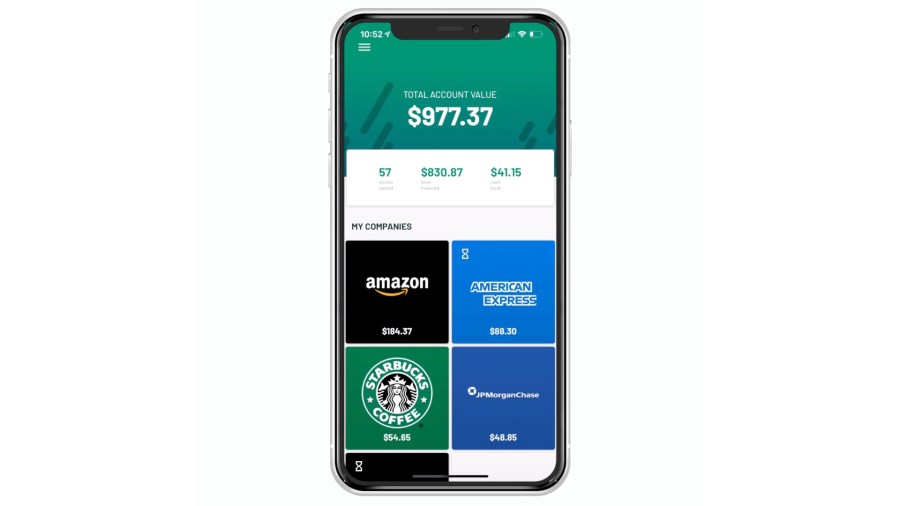

Grifin connects to your bank, credit and debit card and turns your transactions into investments. The candy-colored app automatically identifies the companies you do business with and purchases $1 of their stock, deducting the money from your bank account each week. If you continue to frequent a business, you’ll get another $1 of stock.

Froog says the average person is putting away about $2 to $3 dollars a day.

“I think that … the original purpose of the stock market is to own the companies that you do believe in,” said Froug. “Go order a bowl at Chipotle and now you own Chipotle … go pick up your favorite video game at Best Buy, now you’re a Best Buy owner.”

The app lets you see all of the companies you are invested in, as well as the top companies that other people using the app are invested in.

Of course, Grifin also allows you to exclude certain companies you might not want to own stock in.

“[What] we’ve really seen a lot of is that people are turning off oil companies,” explained Froug.

The simple to use app launched in November after what Froog described as completing piles and piles of paperwork to satisfy financial rules and regulations.

Since this is investing, your original contributions can still lose all of their value, but accounts are insured by the SIPC in the case that Grifin somehow goes away.

The app has seen a boost in the aftermath of the Gamestop excitement, but that doesn’t mean it’s meant for day traders. Grifin is best for long term stockholders since you don’t find things like day trading, options and other complicated features.

The goal is to make investing so easy that people do it earlier and often.

“It’s supposed to be fun, it’s supposed to be healthy, it’s supposed to be safer, it’s just an alternative to traditional investing in general,” explained Froug. “It’s something that everyone deserves to do, I believe it should be a human right to be an owner, to invest, to grow wealth, to feel good about it.”

Follow Rich DeMuro on Instagram and listen to the Rich on Tech Podcast, which is filled with the tech information you should know plus answers to the questions you send Rich!