Credit card companies are experimenting with new technology in an effort to further fight fraud.

That shiny new chip on your credit card has done a lot to combat fraud, but there’s still more to be done. Banks are experimenting with everything from fingerprint scanners to numbers that constantly change.

Follow KTLA Tech Reporter Rich DeMuro on Facebook or Twitter for cool apps, tech tricks & tips!

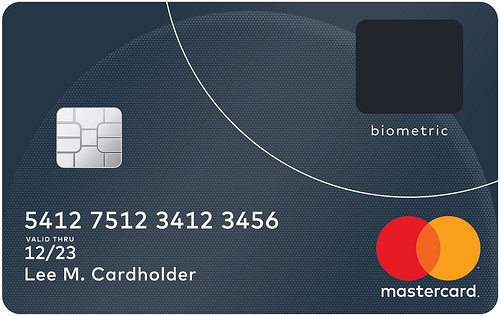

For starters, Mastercard recently unveiled a new biometric credit card. It uses a fingerprint reader to verify your identify before a transaction can go through.

Image Courtesy Mastercard

The company currently testing the card at grocery stores in South Africa.

Recently, I visited a company called Oberthur Technologies. They manufacture the cards that are in wallets worldwide.

After a very serious security check, I got to see everything from glow in the dark cards to cards you can scratch and sniff!

They have pioneered a new feature called motion code that fights fraud in an entirely new way. The card verification value (CVV), you know the digits on the back of your card – is actually a tiny digital display made of electronic ink like you would find on a Kindle.

The number changes at regular intervals, so even if someone steals your card number, it won’t work.

“That motion code effectively provides a degree of security for online transactions that you don’t have today,” explained Martin Ferenczi, Oberthur Technology’s President for North America.

A bank in France is the first to offer them to customers, who pay about 1 Euro extra month for the more secure card. Also, since there is a battery inside, the average lifespan of the card is about 3 years.

One more way to protect your card: tap your phone!

Apple Pay, Samsung Pay and Android Pay don’t actually transmit your real credit card number to merchants – they send a one-time code through the system, which means your original digits are never shared. This is more secure in case a business gets hacked since your credit card won’t be affected.

Bonus: Here is a look at 8 unique credit cards I saw at Oberthur!

[protected-iframe id=”acf5aeaaddcf1a4c71e328a045d84479-41641936-42315212″ info=”https://www.facebook.com/plugins/video.php?href=https%3A%2F%2Fwww.facebook.com%2FRichOnTech%2Fvideos%2F1679452662072446%2F&show_text=0&width=560″ width=”560″ height=”315″ frameborder=”0″ style=”border:none;overflow:hidden” scrolling=”no”]