The insurance industry has long relied on data and actuarial tables that quantify risk and determine policyholder costs.

That data has largely been thrown out the window.

Climate change means erratic temperatures, more storms and more wildfires. Which is to say, it’s a whole new game for insurers.

The president of Aon, one of the world’s largest insurance brokers, testified before a congressional panel a few months ago that insurers are responding to climate change by raising costs and exiting high-risk markets such as California.

Aon’s Eric Anderson told lawmakers that climate uncertainty has created “a crisis of confidence around the ability to predict loss.”

He added: “Just as the U.S. economy was overexposed to mortgage risk in 2008, the economy today is overexposed to climate risk.”

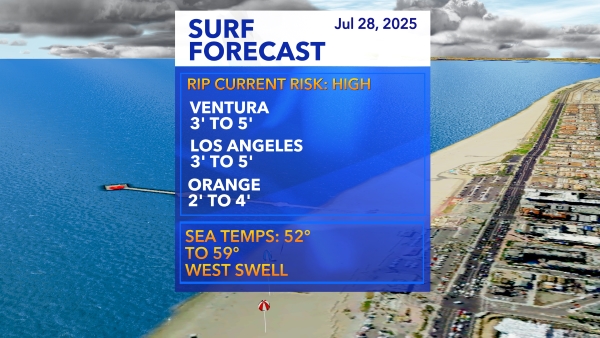

Sunday’s storm and earthquake in Southern California served as a harsh reminder that flooding and quakes aren’t covered by most homeowner policies.

They also reminded homeowners about the precariousness of their situation. A number of top insurers have left or are leaving the California market because it’s gotten too hard to predict the risk of wildfires.

Remember: The insurance business isn’t based on paying claims. It’s based on managing risk.

And the simple fact is that the industry is almost starting from scratch in creating risk models that reflect a changing climate.

They’ll get there. But the new actuarial tables almost certainly will entail higher premiums and deductibles to minimize insurers’ exposure to the unknown.

In the meantime, here are some steps to consider:

First, contact your insurance broker. Ask him or her if you have sufficient coverage for current market conditions and the best available price.

Next, walk around your home with your phone shooting a video of your possessions. The last thing you want is to get into a fight with your insurer about the size of your big-screen TV or the quality of your home-entertainment system.

Finally, if you’re a renter, look into renters insurance. Your landlord is covered, but only for damage to the structure. Your possessions are not covered under your landlord’s plan.

To protect yourself, a renters policy will ensure that you have coverage above and beyond what the building owner is paying for.

Bottom line: The world is changing and risks are growing. Insurance policies will have to reflect this.

And it won’t be cheap.