Actors Jeff and Beau Bridges, along with their sister, own a four-bedroom Malibu home with access to a semi-private beach and panoramic views of the Pacific Ocean.

They inherited it from their mother, who had owned the house since the late 1950s when their father Lloyd Bridges first made it big in Hollywood.

Earlier this year, they advertised the “stunning Malibu dream” for rent at $15,995 a month — a hefty price tag for a house that has a property tax bill of less than half that.

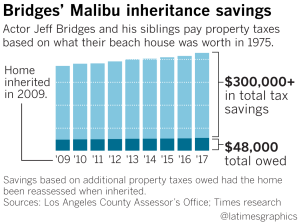

Like other descendants of a generation of California homeowners, the Bridges enjoy a significant perk that keeps their property tax bill low. Part of that is thanks to Proposition 13, which has strictly limited property tax increases since 1978. But they also benefit from an additional tax break, enacted eight years later, that extended those advantages to inherited property — even inherited property that is used for rental income.

Read the full story on LATimes.com.

California lets parents pass their low property taxes to their kids. Those kids now are making a ton renting out their parents' homes. Jeff Bridges and his siblings pay $6k a year in taxes and listed their home for $16k a month in rent. Some beneficiaries: https://t.co/PrjHV7AhRG pic.twitter.com/cbE4Kqzbyr

— Liam Dillon (@dillonliam) August 17, 2018

“The tax break, [SCOTUS Justice] Stevens wrote, ‘establishes a privilege of a medieval character: Two families with equal needs and equal resources are treated differently solely because of their different heritage.’” Must-read reporting and analysis from @dillonliam and @bposton https://t.co/2U9W43ibck

— Melanie Mason (@melmason) August 17, 2018