(NEXSTAR) – California hasn’t sent out the Middle Class Tax Refund yet, but you can see how much you’ll be getting in the meantime.

The direct payments, also referred to as “inflation relief” payments by legislators, will be sent out to more than 20 million starting in October. The payments will range in size from $200 to $1,050, depending on the size of your income and number of dependents.

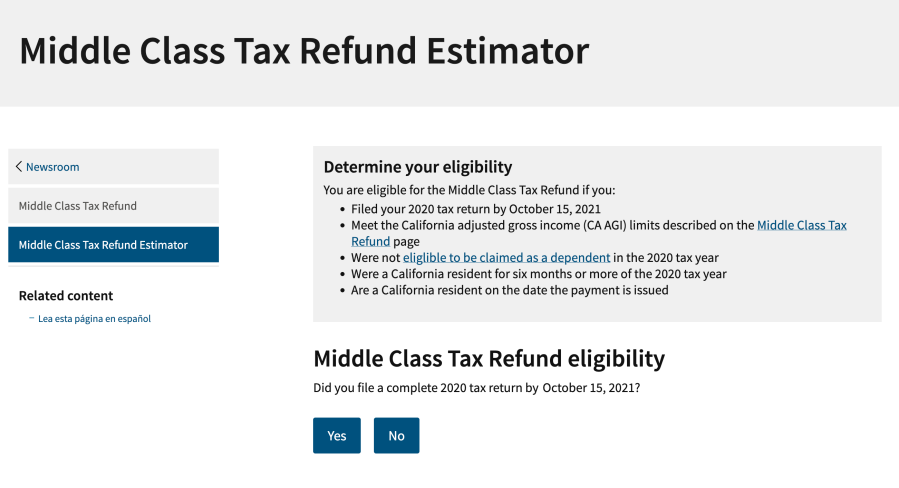

The Franchise Tax Bureau has created a calculator tool that allows you to estimate the size of your payment by answering six questions. Click the image below to open the FTB’s Middle Class Tax Refund Estimator, or visit their site here.

We’ve also created three charts that show the payment amounts for every tax filing status, income level and number of dependents, which you can see here.

If you qualify based on the info on your 2020 tax return, you don’t need to do anything to get the money. The payment will be issued to you automatically.

California will issue the payments – also known as the middle class tax refund – two ways: direct deposit and debit cards. Most people who filed taxes electronically can expect a direct deposit, though there are some exceptions that could mean you’ll be getting a debit card in the mail.

The payments will start to be issued in October, and most will have received their money by January 2023, the FTB says.