Applications for California’s down payment assistance program for first-time homebuyers are now open.

The state-funded program, called Dream For All, will be giving out $250 million to assist thousands of first-time homebuyers this year. Buyers can receive up to $150,000 towards their purchase.

Who is eligible to apply?

- All borrowers, including co-borrowers, must be a first-time homebuyer, defined as someone who has not owned a property or lived in a home owned by a spouse during the past three years

- At least one person must be a first-generation homebuyer meaning their parents do not own a home in the United States

- All applicants must be California residents

- Borrowers must plan to reside in the home as their primary residence

- Applicants must make under the income limit threshold. Each California county will have a different income limit

- Applicants must have a credit score of 680 or higher and a debt-to-income ratio of no more than 45%

- Anyone who has ever been placed in foster care will be eligible

How does the shared appreciation loan work?

The program will provide a loan of up to 20% of the purchase price of a home or a maximum amount of up to $150,000. The money can be used to help finance a down payment, closing costs or a first-time mortgage.

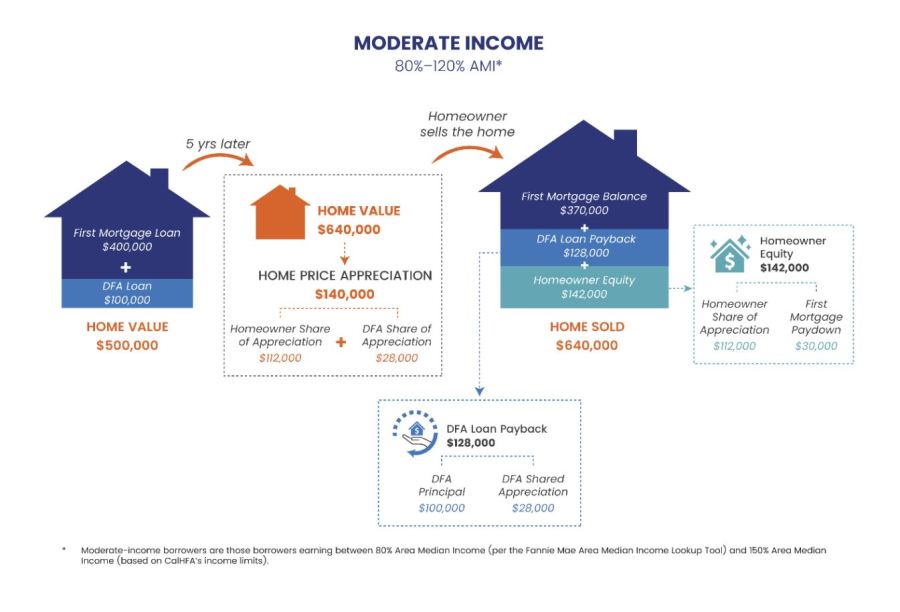

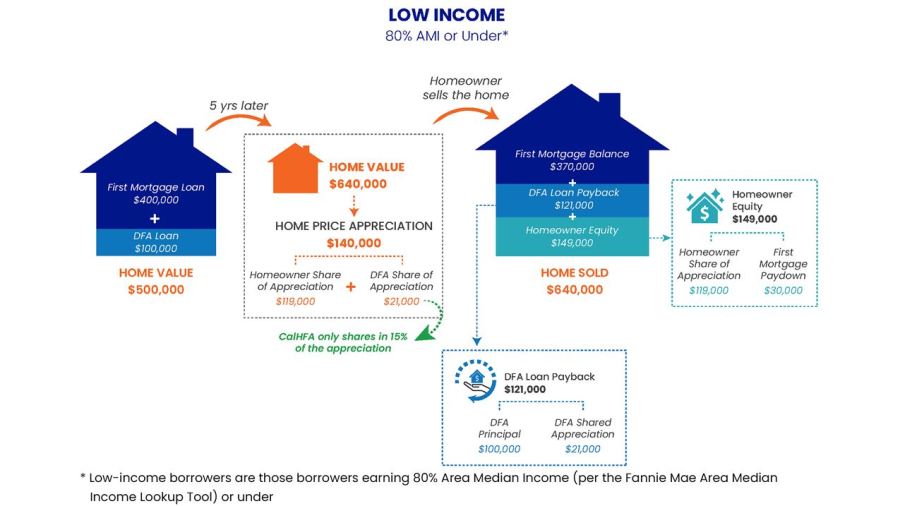

For example, if you bought a $500,000 home, you’d receive 20%, or $100,000, to help with your down payment and closing costs.

If you sell the home in the future, you’ll be required to pay back the 20% loan, plus 20% of the home’s appreciation.

For example, if the $500,000 home sells for $700,000, there is a $200,000 appreciation. You would owe 20% of that — or $40,000 — in addition to the original loan.

However, if you sell your home and it hasn’t grown in value at that time, you would only need to pay back the original 20% loan.

There are exceptions for borrowers whose incomes are less than or equal to 80% of the Area Median Income. For those borrowers, they would only need to pay back 15% of the home’s appreciation, along with the original loan. To see if your income qualifies, use the HomeReady Lookup Tool found here.

How do I apply?

Online applications for the Dream for All program are now open beginning April 3 and will close on April 29 at 5 p.m.

The winners will be chosen at random by lottery and not on a first-come-first-served basis as previously done in 2023.

All borrowers will need to complete homebuyer education counseling and get a certificate of completion through an eligible homebuyer counseling organization.

Officials advise potential applicants should speak with a CalHFA Approved Lender who is offering the Dream For All program to determine what documents and information may be needed.

What happens if you’re selected?

Chosen applicants will have 90 days to find their home, enter into a contract to purchase the home, and have the lender reserve the loan through CalHFA’s Mortgage Access System.

Those who aren’t ready to speak with a loan officer just yet can also talk to a free HUD-approved housing counselor who can analyze your finances and help you better prepare.

The Dream for All program first debuted in March 2023 as thousands of homebuyers quickly snatched up the $300 million allotted for the payments.

Online applications and information on the California Dream For All program can be found here. The program’s official handbook can be found here. All documentation borrowers will need to apply can be found here.