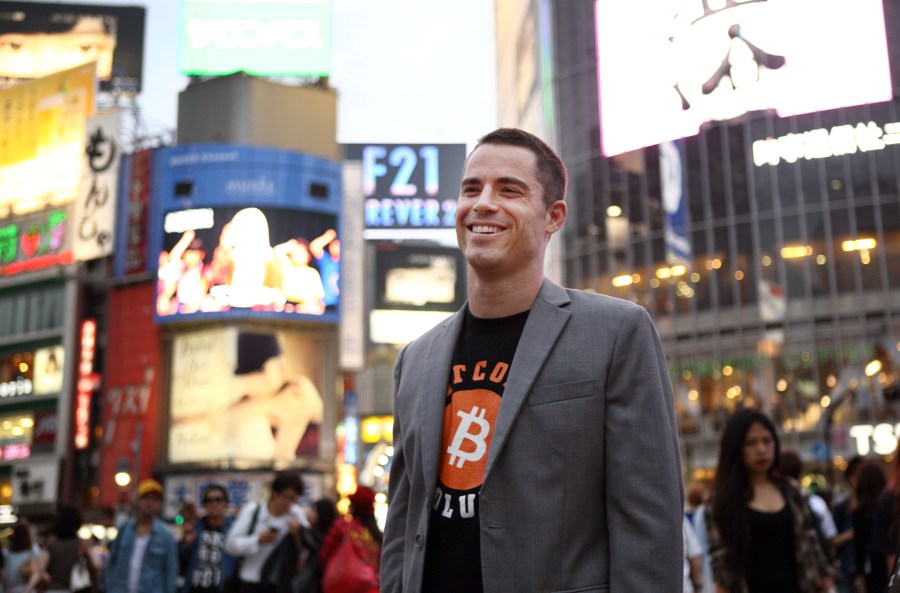

An early investor in Bitcoin who made millions acquiring the cryptocurrency and later called himself “Bitcoin Jesus” has been arrested to face charges of fraud.

Roger Keith Ver, 45, was arrested this past weekend in Spain. He was previously a resident of Santa Clara, California and most recently lived in Tokyo.

Ver faces three counts of mail fraud, two counts of tax evasion and three counts of subscription to a false tax return, according to the United States Department of Justice.

The DOJ says it will seek to extradite Ver to the U.S. to face the charges.

Ver was an early adopter of Bitcoin, acquiring hundreds of whole coins through two businesses he owned that sold computer and networking equipment. He heavily promoted the cryptocurrency online, which later led to him adopting the “Bitcoin Jesus” moniker, the DOJ said.

In February 2014, Ver obtained citizenship in St. Kitts, an island in the Caribbean, and renounced his U.S. citizenship, a process called expatriation. As part of that process, he was required under federal law to file tax returns that reported capital gains from the sale of his worldwide assets, including bitcoin, and to report the fair market value of his assets.

He was also required to pay a tax, known as an “exit tax,” on those capital gains as part of his expatriation efforts.

According to the DOJ, Ver and his companies owned approximately 131,000 whole bitcoins that traded on several large cryptocurrency exchanges at a price of about $871 each. Ver’s two companies allegedly held around 73,000 of those coins.

Authorities say Ver hired a law firm to assist with his expatriation and to help prepare his related tax documents. He allegedly hired an appraiser to value his two companies, but provided false or misleading information to conceal the actual amount of cryptocurrency he and his companies owned.

As a result of his alleged deception, the law firm prepared his tax documents and substantially undervalued the two companies and their 73,000 bitcoins. Ver himself reported that he did not own any Bitcoin personally.

His indictment also alleges that by June 2017, Ver’s two companies continued to own about 70,000 whole bitcoins. The DOJ said he transferred those bitcoins to himself in November and then sold tens of thousands of them on cryptocurrency exchanges, netting himself around $240 million. The average closing price of bitcoin in November 2017 was more than $7,800, according to Statmuse.

Even though he was no longer a U.S. citizen, Ver was still legally required to report those transactions to the IRS and pay taxes on certain distributions because his two companies were U.S. corporations.

The DOJ alleges that Ver also withheld information from his accountant about transferring and selling the bitcoins and did not report any gain or pay any taxes related to the transaction in his 2017 individual return.

Authorities allege that Ver caused a loss to the IRS of at least $48 million.

If convicted of all charges, Ver would face a maximum sentence of 20 years in federal prison for each mail fraud count, up to five years in federal prison for each tax evasion count and up to three years in federal prison for each count of subscribing to a false tax return.

The case remains under investigation by the IRS.

A 2014 profile in Bloomberg details Ver’s efforts to attract more rich crypto investors to become citizens of St. Kitts, boasting about the island’s lack of taxes on personal income or capital gains.

For those curious, today, a single Bitcoin is worth more than $60,000.