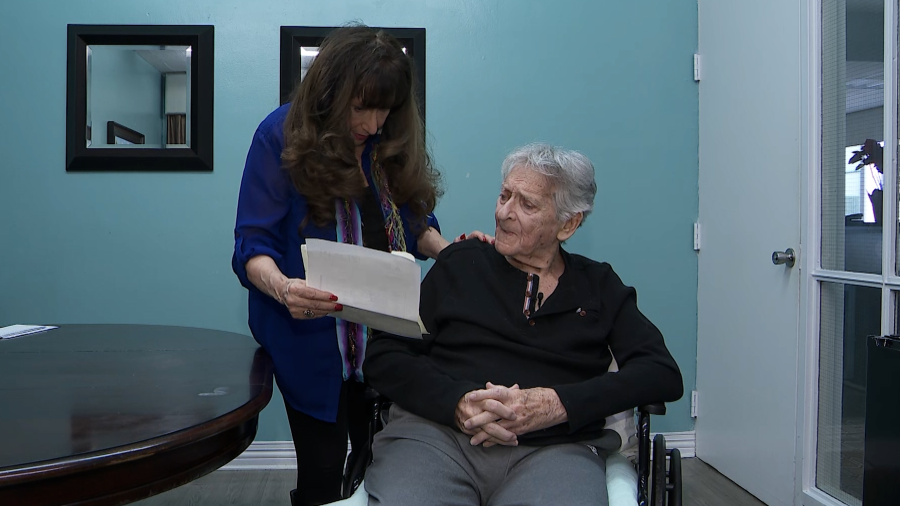

Marvin Braverman is 85. A former writer and performer, he’s now in a Los Angeles nursing home dealing with assorted ailments.

And for the last 18 years, AOL — yeah, you’ve-got-mail AOL, the company that once owned the internet and is now barely on life support — has been dinging Braverman with monthly fees to the tune of $5,000.

“They’re taking bread off my table,” Braverman told me. “The food is coming off the table because that money could have been used to live on.”

Worse, he has no idea how he got signed up for some cybersecurity plan with a recurring monthly fee.

“They were taking $36.99 every single month since 2019,” says Braverman’s friend, Marilyn Anderson. “I looked at all his bills. Then, since 2016, they were taking $34, and going back as far as 2006, I found they were taking $12 a month.”

Anderson met Braverman at a comedy club decades ago. They’ve been friends ever since, and she now has power of attorney over his legal affairs.

“Unfortunately, I think a lot of people don’t look carefully at their credit card statements or their bank statements,” she said. “And Marvin, unfortunately, has been in and out of the hospital a lot, and that makes it even harder.”

This isn’t a story about a company doing something illegal or unethical. This is a story about a business practice that many companies employ that puts consumers at a disadvantage.

“Often times, you just don’t notice,” noted Jamie Court, president of Consumer Watchdog, a Los Angeles advocacy group.

“It could be an email from the company you didn’t open. It could be some mail that you think is junk mail and you throw it away.”

Braverman has had an AOL account since, well, AOL was still AOL. Nowadays, it’s owned by an investment firm and is a shell of its former self.

It wasn’t until Anderson spotted the charges and combed through Braverman’s past bills that she realized the magnitude of the problem — thousands of dollars lost.

She says AOL offered to refund two months of payments, or about $70. Then they upped it to six months, or about $200. Then a year’s worth, or about $400. And that’s as high as they’d go.

So Anderson got in touch with me.

I’m glad to say that after I contacted AOL, they changed their tune. And now they’re going to make Braverman whole.

The company said in a statement that it “actively communicates” with customers, and offers “clear ways to modify or discontinue their services.” Its goal, it says, is “to ensure everyone can manage their AOL plan with ease.”

While AOL had no obligation to give Braverman his $5,000 back, it’s laudable that they finally did the right thing. And all consumers should keep in mind: You have rights.

Under California law, businesses must receive approval to charge recurring fees, and must notify you about any changes and how to cancel.

You also have a right to request proof that you signed up for any service.

“A lot of times they can’t come up with a signature or that web click, and they’ll give you the money back,” Court said.